Based on

100+ years cumulative experience

With over

3700+ qualified experts

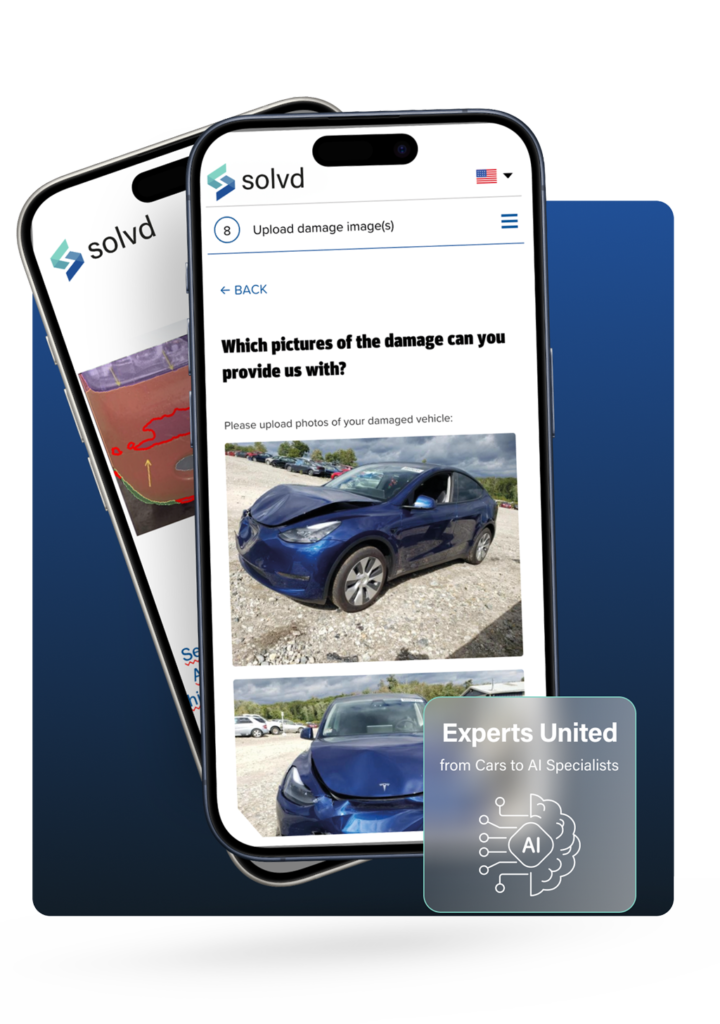

Discover the future of claims and repair management

Setting the new standards for claims and repair management solutions globally.

Our ambition

Offering class-leading claims and repair management solutions while setting new standards for our industry globally.

Professional, fast, and fair claims and repair settlement is one of the most important tasks in the insurance industry, as well as for fleet and leasing companies, and car manufacturers. Our ambition is to offer the best end-to-end claims and repair management solutions on the market, leveraging the highest level of digitalization and automation. Simple, digital, scalable — available in more countries than any other company.

We achieve this by intelligently and systematically integrating the offerings and services of our portfolio companies into a comprehensive solution.

Our vision

We reduce motor claims and repair settlement times to less than a day by harnessing advanced automation, ai-powered tools, and strategic partnerships, ensuring satisfied end customers through our industry expertise and innovation.

Solvd’s vision is to reduce the handling time of motor claims and repair settlements to less than a day. To achieve this goal, we are automating and accelerating the entire claims and repair management process by integrating the best digital and ai-powered tools, as well as implementation partners available on the market.

We are committed to this every day. Our unparalleled industry experience, passion, and entrepreneurial spirit — together with the partners in our network — ensure that our b2b customers achieve highly satisfied end customers.

Our ecosystem

Transforming claims and repair with AI-powered end-to-end solutions

- To achieve end-to-end solutions where claims and repair settlements can be completed in less than a day in the future, it’s not enough to merely digitize a few paper-based processes. We digitize entire process chains, complex services, and personalized customer journeys, ensuring that all successive steps are seamlessly integrated.

- Our approach combines comprehensive industry expertise with a secure, cutting-edge ecosystem, innovative ai-driven data analytics, and smart automation. Our proprietary ecosystem orchestrates all processes, data analyses, ai tools, and our network of implementation partners. With a modular structure, b2b customers can manage claims and repair through all four stages or simply use selected products and services.

Our technology leadership

Shaping the future with AI-driven innovation and expertise

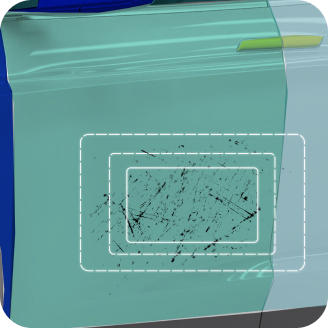

If it says solvd, it’s high-tech. Our employees work in software development, AI and IT services, and programming. In our own research departments, we work on the innovations of tomorrow based on artificial intelligence, deep learning, automatic image recognition, and telematics.

We are one of the most experienced users of AI technologies. Over the years, we have developed and implemented AI-supported, tried-and-tested processes and products, with more than 150 currently in use. To further extend our lead, we are investing in collaborations and research projects with leading universities.

Our B2B customers and partners benefit considerably from our technological leadership in data analytics and predictive digital technologies, as this enables us to avoid or reduce costs. To this end, we can draw on extensive historical data like almost no other company and use it to derive superior analyses for fully automated loss adjustment and fraud prevention.

WE GET IT SOLVD!

Stay connected with Solvd for the latest updates and insights.

![]() info@solvd.group

info@solvd.group